The newly-formed Dubai Investment Fund has been tasked with investing Dubai Government funds, surpluses and the general reserve locally and internationally.

In his capacity as the Ruler of Dubai, His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE has issued a law regarding this.

The Fund will function as Dubai Government’s vested authority when it comes to owning shares in entities like the Dubai Electricity and Water Authority (DEWA), Salik, Dubai Taxi, and other companies directly owned by the Dubai Government.

It will relieve the Dubai Government of rights and obligations related to companies, specifically in the context of ownership of shares, and also contracts, agreements, commitments, deposits, bank accounts, and loans associated with such shares.

All relevant public entities in Dubai are required to register all their assets, stocks, shares, movable and immovable properties, licences, permits, bonds, privileges and other instruments under the Fund.

Additionally, Dubai World will be affiliated with the Dubai Investment Fund while preserving its legal identity as defined by Law No. (3) of 2006 and its amendments regarding the establishment of Dubai World.

The new entity's Board of Directors will be chaired by His Highness Sheikh Maktoum bin Mohammed bin Rashid Al Maktoum, First Deputy Ruler of Dubai. Abdulrahman Saleh Al Saleh serves as Vice Chairman of the Board while Abdulaziz Mohammed Al Mulla, Rashid Ali bin Obood, and Ahmad Ali Meftah are its members.

Al Mulla will also serve as the Managing Director and CEO of the Fund.

The Fund endeavours to actively contribute to the realisation of the emirate's strategic priorities through efficient investments in development projects. All relevant public entities in Dubai must register all their assets, stocks, shares, movable and immovable properties,…

— Dubai Media Office (@DXBMediaOffice) December 11, 2023

The Fund seeks to bolster the financial stability of the Dubai Government by financing its deficit and establishing strong reserves, thereby promoting long-term financial sustainability.

It will focus on investments in stocks, bonds, and securities to achieve sustainable returns and can explore prospects in local or international financial markets while following investment policies approved by the Board of Directors.

Additionally, it can deal in movable and immovable assets, manage funds, provide mortgages and guarantees, besides participating in the financial derivatives business, all in compliance with Dubai's laws.

Dubai Police bust online car sale scam

Dubai Police bust online car sale scam

13-month-old receives Dubai’s first pediatric liver transplant

13-month-old receives Dubai’s first pediatric liver transplant

UAE plans facial recognition ID system; no card needed

UAE plans facial recognition ID system; no card needed

UAE President congratulates Syrian counterpart on Evacuation Day

UAE President congratulates Syrian counterpart on Evacuation Day

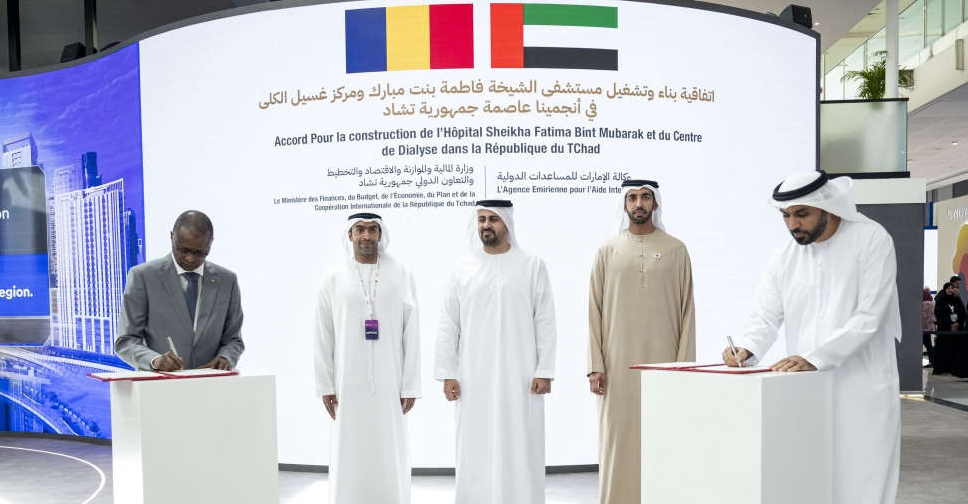

UAE to build hospital and dialysis centre in Chad

UAE to build hospital and dialysis centre in Chad