A group of the world's richest nations reached a landmark deal on Saturday to close cross-border tax loopholes used by some of the world's biggest companies.

The Group of Seven said it would back a minimum global corporation tax rate of at least 15%, and put in place measures to ensure taxes were paid in the countries where businesses operate.

"After years of discussion, G7 finance ministers have reached a historic agreement to reform the global tax system to make it fit for the global digital age," British finance minister Rishi Sunak told reporters.

The accord, which could form the basis of a global pact next month, is aimed at ending a decades-long "race to the bottom" in which countries have competed to attract corporate giants with ultra-low tax rates and exemptions.

That has in turn cost their public coffers hundreds of billions of dollars - a shortfall they now need to recoup all the more urgently to pay for the huge cost of propping up economies ravaged by the coronavirus crisis.

Ministers met face-to-face in London for the first time since the start of the COVID-19 pandemic.

According to a copy of the final agreement seen by Reuters, the G7 ministers said they would "commit to a global minimum tax of at least 15% on a country by country basis".

"We commit to reaching an equitable solution on the allocation of taxing rights, with market countries awarded taxing rights on at least 20% of profit exceeding a 10% margin for the largest and most profitable multinational enterprises," the text added.

The ministers also agreed to move towards making companies declare their environmental impact in a more standard way so investors can decided more easily whether to fund them, a key goal for Britain.

Rich nations have struggled for years to agree a way to raise more revenue from large multinationals such as Google, Amazon and Facebook, which often book profits in jurisdictions where they pay little or no tax.

U.S. President Joe Biden's administration gave the stalled talks fresh impetus by proposing a minimum global corporation tax rate of 15%, above the level in countries such as Ireland but below the lowest level in the G7.

Thousands of Australians without power as cyclone Alfred hits

Thousands of Australians without power as cyclone Alfred hits

Israeli airstrike kills two in southern Gaza

Israeli airstrike kills two in southern Gaza

12 people injured in Toronto pub shooting

12 people injured in Toronto pub shooting

Cyclone Alfred downgraded as millions stay indoors

Cyclone Alfred downgraded as millions stay indoors

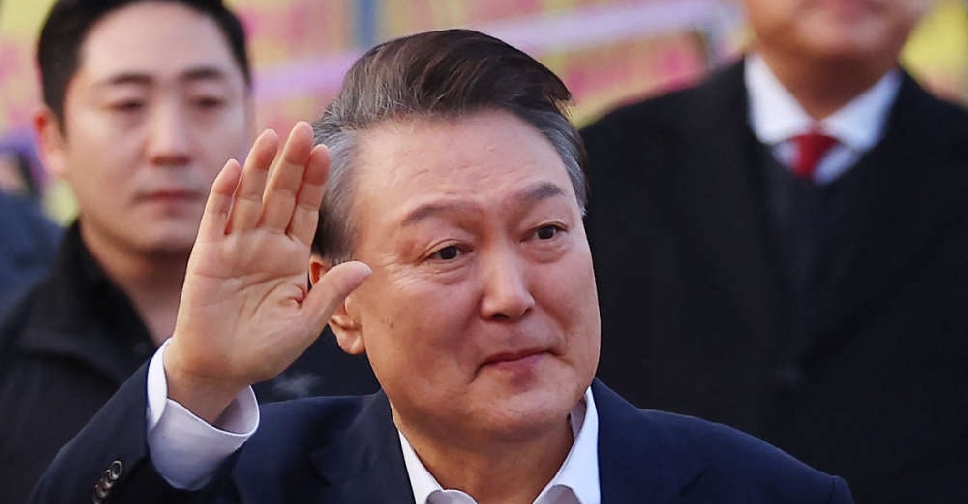

South Korea's President Yoon free, trials continue

South Korea's President Yoon free, trials continue