Australia survived sold out Taylor Swift concerts in Sydney and Melbourne without a spike in inflation as travel and hotel costs in other parts of the vast country swung lower in February, leaving interest rates on track to be cut later in the year.

Data from the Australian Bureau of Statistics on Wednesday showed its monthly consumer price index (CPI) rose at an annual pace of 3.4 per cent in February, unchanged from January and under forecasts of 3.5 per cent.

For the month, CPI rose 0.2 per cent. The three-month annualised pace is 2.4 per cent, within the central bank's target band of 2 per cent to 3 per cent.

The Australian dollar AUD=D3 eased 0.2 per cent to $0.6519 and three-year bond futures YTTc1 bounced from earlier lows to be up 2 ticks to 96.42, while markets continued to bet that any rate relief would likely start in August or September.

"While it may appear that inflation has bottomed out, base effects over the coming months should make it easier for inflation to resume its descent," said Rob Carnell, Asia-Pacific head of research at ING, adding it raised the possibility for some monetary easing later this year.

However, a closely watched measure of core inflation was proving stickier. The trimmed mean rose an annual 3.9 per cent, up slightly from 3.8 per cent in January. Policymakers had forecast the gauge to fall to 3.6 per cent by June.

Markets imply around a 68 per cent chance the Reserve Bank of Australia will cut its 4.35 per cent cash rate by a quarter point in August, while a move is fully priced in for September. Futures imply a relatively modest 40 basis points of easing for all of 2024.

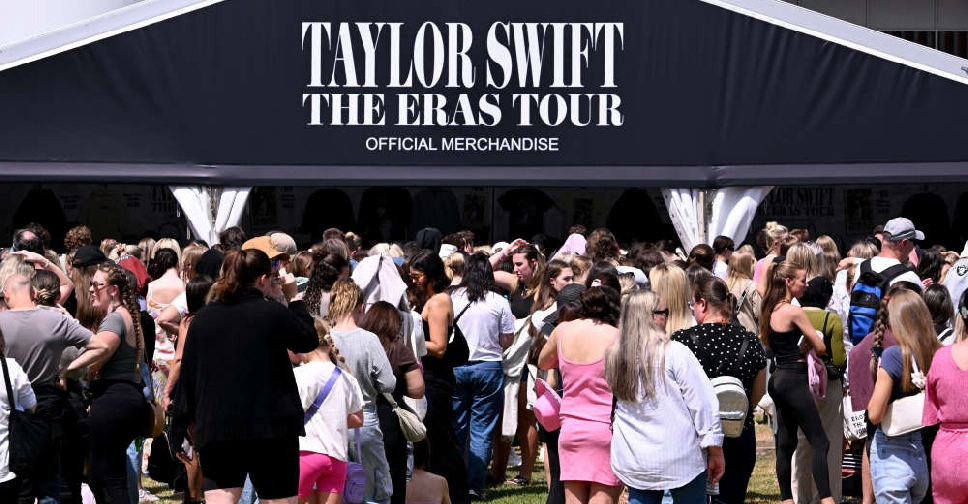

The Taylor Swift effect that drove up travel and hotel-related costs in the country's biggest cities had some analysts looking for an uptick in headline inflation in February.

"Although Taylor Swift performances saw hotel prices rise in Sydney and Melbourne, elsewhere accommodation and airfare prices fell in February due to the end of the peak travel during the January school holiday period," said Michelle Marquardt, ABS head of prices statistics.

Holiday travel and accommodation prices fell by 9.3 per cent in February from the previous month, helping to offset gains in fuel, education and clothing.

Prices for tradable goods were all but flat in the month, while non-tradable items that are mainly services rose 0.3 per cent.

Kendrick Lamar, Post Malone lead American Music Awards nominations

Kendrick Lamar, Post Malone lead American Music Awards nominations

Sharjah Children's Reading Festival brings new chapter of surprises

Sharjah Children's Reading Festival brings new chapter of surprises

Metallica to perform at Abu Dhabi Grand Prix

Metallica to perform at Abu Dhabi Grand Prix

Hatta's 'largest' art installation focuses on reflection

Hatta's 'largest' art installation focuses on reflection

Global Village welcomes music sensation Atif Aslam

Global Village welcomes music sensation Atif Aslam